A Beginner Guide to the P60 Tax Form

What It Is, How To Fill It Out and When To Use It

Completing a P60 tax form can seem overwhelming, especially if you've never done it. But don’t worry - understanding the P60 and filling it out correctly is easier than you think! This beginner's guide will explain what the P60 form is, how to fill it out, and when to use it. A P60 is a certificate issued by your employer that tax details your pay and the tax deducted from it over the year. It is an important document you will need to keep for your records and, in some cases, to provide to HMRC. Understanding the P60 form and how to fill it out correctly will help you ensure that you are paying the right amount of tax, and will help you to avoid any misunderstandings or disputes with HMRC.

What is a P60 tax form?

A P60 tax form is a document provided by an employer detailing employee earnings and the amount of overpaid tax and National Insurance contributions deducted from it over the tax year. The P60 is important because it lets you know how much tax you should have paid. If you need to make a claim, it will confirm your due amount. A P60 also serves as a record of your earnings and tax deductions for your records. The name P60 comes from the fact that it is the 60th day of the year that the P60 is issued. So, if you started a new job in April, the P60 for that tax year would be issued on April 30th. If you want a p60 self-employed, you can get one by buying P60 online and you will have to pay your taxes by registering yourself as an employee. You can use the P60 you get from your employer as proof of your earnings. Click to Buy P60 2021 and 2022 P60

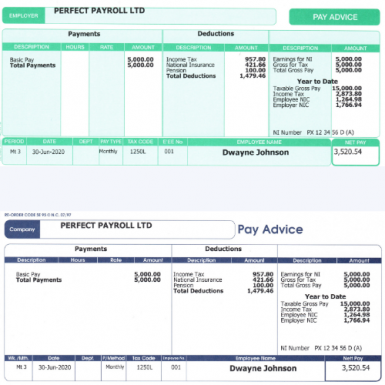

How to fill out a P60 tax form

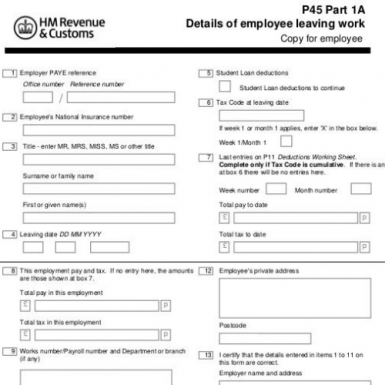

In the UK, the standard number of P60s issued annually from one employement is one. However, you may receive two P60s if you had two jobs in the same year or received income from both employed and self-employed work. HMRC website is a great source to check information on P60. If you are self-employed, you will not receive a P60. Instead, you will receive an IR150 form that details your earnings and tax deductions. - It is an employers resposbility to fill and compute the p60 forms for an employee starting by inputting employees name and address. Make sure to input exact name and address as given by the employee at the time of employment contract. - Entering business PAYE reference is also an important part as it help HMRC reognising the company within their systems. This is a ten-digit code beginning with a ‘W’ that was issued to you by your employers and allowed the payments of your taxes to be automated. You will find this code in the top right-hand corner of your P60.

When to use a P60 tax form

A P60 is essential for employees to use when completing a tax return or providing evidence of income to another party.

It’s important to remember that employers are legally required to provide their employees with a P60 tax form after the end of each tax year (April 5th to April 6th). Employers should have these forms ready for distribution no later than May 31st each year. If you don’t receive a P60 by this date, you should contact your employer directly as soon as possible to ensure that you get one.

A P60 will include information such as:

- Your total earnings for the tax year

- The amount of tax and National Insurance deducted from your pay

- Any Student Loan repayments you made

- Any other benefits you received from your employer

By having all of this information on one document, it can help make completing a tax return much easier. Furthermore, you may need to present a P60 when applying for certain financial products such as loans or mortgages.

If you generate your wage slip online, you can easily produce a P60 form from your own records. This is convenient and eliminates any potential delay in receiving the documents from your employer. Additionally, it can provide a great level of convenience and security when it comes to keeping track of your earnings and deductions over the course of the year. Get P60 for mortgage as proof of your income, Do P60 request from your employer specially when it is needed to show as your income evidence. If your employer is no longer in business you can order P60s online.

How to keep your P60 tax form safe

- Your P60 tax form is very important, so keep it safe and secure. You can store your P60 tax form in a file. You can also scan your P60 and save a digital copy on your computer or phone. This is a good idea if you are self employed or receive non-PAYE income since you will not receive a P60. - If you store your P60 digitally, ensure the information is secure. If you file your P60 with HMRC, you will need to keep a copy for yourself. - Be sure to keep your P60 tax form for at least three years, even if you have no plans to make a tax claim. This is because the government may ask you to prove your income later. In this scenario, your P60 will be crucial.

Conclusion

In conclusion, completing a P60 tax form can seem overwhelming, especially if you've never done it before. But don’t worry - understanding the P60 and filling it out correctly is easier than you think! This beginner's guide will explain what the P60 form is, how to fill it out, and when to use it. A P60 is a year certificate issued by your employer that details your payments and the tax deducted over the year. It is an important document you will need to keep for your records and, in some cases, to provide to HMRC.