Employers Obligation in issuing P45 Document and Its Challenges for Employees

An overview on P45 Form

P45 form is provided to an employee by its employer when an employee terminates their job.

Employer must give all the employees a P45 when they finish working for the company. P45 online are easily generated by the payroll software.

P45 is an important document that shows the amount of tax an employer paid on employee’s behalf on their salary. The standard tax year runs from 6th of April to 5 April).

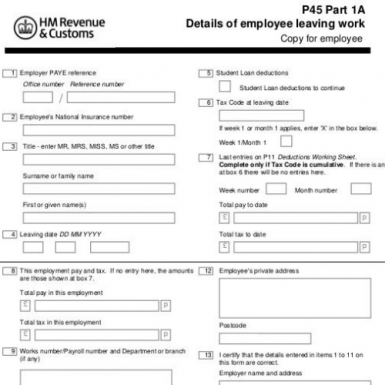

A P45 form is made up 4 parts (Part 1, Part 1A, Part 2 and Part 3).

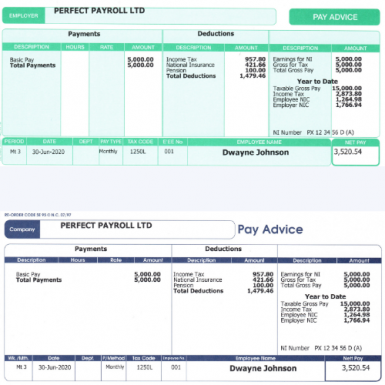

- The details shown on P45 include Tax code, Gross Pay, Taxable earnings so far this tax year and any tax paid, employer and employee details. The old employer’s PAYE (Pay As You Earn) tax references

- An employer is responsible to send details to HM Revenue and Customs (HMRC) by providing Part 1 and rest of the other parts are given to the employee.

- An employee should give Part 2 and 3 to the new employer (or to Jobcentre Plus if you’re not working). This help in calculating correct taxes and National insurance.

- Part 1A is for employee’s own records. It is advisable to keep it safe

When do I need p45

If you are planning to leave your job for a new one, or if you have retired or sacked. Eventually if your employment has been terminated the P45 document should be given. Starting a new job? then you will need the P45 document to provide it to your new employer. It is very common for employees to misunderstand the use of P45 document and how it can directly affect your salary and therefore we have tried our best to explain its use and benefits.

What happens if I have no p45

By law it is your employer’s responsibility to issue P45 at the time of terminating your job. If you have not been given, then you are by law in your own right to ask your Employer for P45. P45 documents are not optional to you as an employee, they are an official document that you have a right to receive when leaving a company.

In an event where you have lost P45, ask your past employer to reissue the copy. Your employer can very easily issue a replacement P45 online or by email. It is important to understand that you won’t be asked for P45, if this is your first job or if you are taking up second job. Check out our P45 section and order a replacement online.

Your new employer will need to calculate the tax you should be paying on your gross salary.

If you’re starting your first job

- you’re taking on a second job

- you cannot get your P45 from your previous employer

If you have lost P45 you’ll need to disclose your old employment details to your new employer or the information about other jobs you may have, any benefits you may be getting and if you have a student loan. In this type of situations, the employer may ask you to either fill in a ‘starter checklist’ or give the information in another way. Your employer will use this information to calculate your correct tax code, deductions before your first payday.

How long is a P45 valid for?

Employers should keep P45 documents for minimum of six years, like all tax records P45 is also an important document and should be kept by the employee as long as possible since HMRC can investigate or commence some necessary checks up to 20 years.

Conclusion

P45 document is an important document and must not be ignored at the time of leaving the job as it can have some serious negative effects in calculating the employee tax and deductions correctly. The employers can be lawfully sued if they fail to issue P45 to an employee. To avoid any future issues Order P45 online now.