How to Obtain a Replacement P60 for Your Business

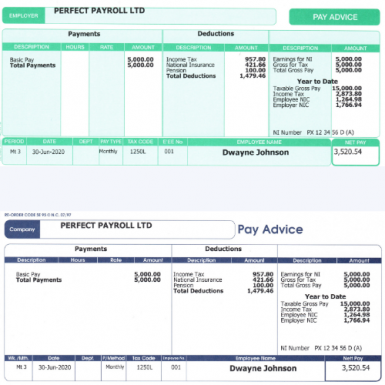

A P60 is an end-of-year statement issued to all employees by their employer. It outlines the amount of tax, National Insurance Contributions (NIC), and other deductions that were taken from the employee’s salary during the course of the year. If you are a business owner and you need to obtain a replacement P60, this blog post outlines how to do so.

What Is a P60?

As mentioned above, a P60 is a document that is issued to any employee who was employed by your business in the last tax year. It will include details of their gross pay, deductions taken from their pay, and also information about any benefits or expenses they have received from your business throughout the year. This document needs to be given to each employee before the 6th April in each tax year.

How Does an Employer Obtain Replacement P60s?

If an employee loses or does not receive their original P60 then it is possible for them to obtain a replacement copy from HMRC. There are two ways that employers can get hold of replacement copies – either online or via post.

To get new copies online, you must register on HMRC’s website and complete either form P46(pen) or form P46(car). You will need your PAYE reference number and unique taxpayer reference number (UTR) in order to register on HMRC’s website. Once you have registered and completed form P46(pen) or form P46(car), you will be able to print off replacement forms for your employees using the Government Gateway system.

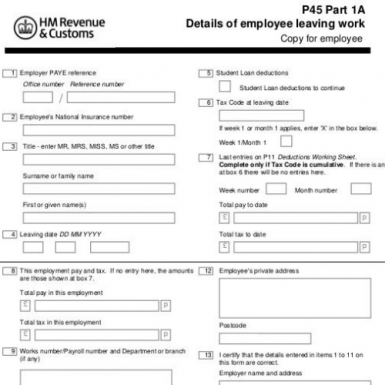

Alternatively, if you prefer not to use HMRC’s website then you can send off paper copies of form P45 Parts 3 & 4 along with form PW1/PW2 via post instead. It should take around 10 working days for these forms to arrive at HMRC once they have been posted out.

Conclusion

Whether it's due to loss or simply never receiving it in the first place, businesses must understand how they can obtain replacement copies of their employees' P60 documents when needed. By following either one of these steps outlined above - registering on HMRC's website or sending paper copies via post - businesses can easily replace lost documents with ease! Ultimately, obtaining new documents helps ensure that both employers and employees remain compliant with government regulations as well as staying up-to-date with their taxes throughout the year!