In-House Payroll Challenges for Small Businesses

Running payroll in-house can be a daunting task for small businesses. Dealing with the complexities of payroll taxes, compliance, and employee needs can be overwhelming, especially when you don’t have an experienced payroll specialist on staff. This blog post will take a look at some of the most common payroll challenges small businesses face when handling payroll in-house. We'll discuss how to prepare for and manage these challenges, as well as the advantages of outsourcing payroll. By the end of this post, you should have a better understanding of the challenges of in-house payroll for small businesses and how to best handle them.

The need for speed

When it comes to payroll, speed is essential. Small businesses are often working on increasing business sales and working on tight deadlines due to which payroll activities take the back seat. The payroll process must be quick and efficient as employees rely on their end-of-month salary. In-house payroll solutions allow businesses to save money. However, managing weekly or monthly payroll quickly and accurately is the biggest challenge when running payroll in-house. In this day and age outsourcing payroll can be one of the cheap, speedy and best options, doing so will allow the business owners to focus on other important areas of their business. However, speed isn’t the only challenge small businesses face when managing payroll in-house.

The complexity of compliance

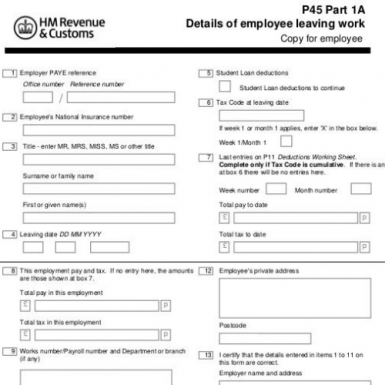

When it comes to payroll, businesses of all sizes have to deal with a range of regulations and laws. However, small businesses often face greater difficulty when it comes to understanding and adhering to the various rules and regulations. On top of this, some ever-changing laws and policies need to be taken into account. Not only do these need to be understood, but they must also be complied with at all times.

Failure to do so can result in serious penalties, ranging from fines to backdated taxes and legal action. Small businesses don’t always have the expertise or resources to keep up with these changes or handle the compliance aspect of payroll properly. This makes it even more important for them to outsource their payroll needs to a reliable provider that understands the nuances of payroll compliance.

The importance of accuracy

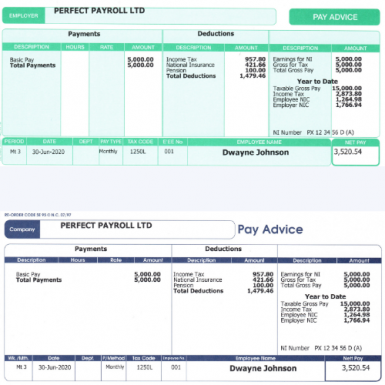

Accuracy is critical when it comes to payroll. Mistakes can be costly and can result in employees not receiving the correct payslips, pay or benefits, or even fines and penalties for the business. This is especially true when it comes to calculating deductions and withholding. Employees rely on their employer to accurately manage their income, deductions and contributions, and a mistake could mean they are overpaying or underpaying tax, or not getting the benefits they are entitled to.

Businesses need to be sure that their payroll systems and processes are up-to-date and working properly so that all calculations on payslips are accurate. This includes ensuring that the payroll system is integrated with other systems that can affect pay calculations, such as timesheets, human resources information, and benefits programs. Additionally, businesses need to be aware of changing laws and regulations that could affect payroll calculations.

Finally, it’s important to review payroll records regularly to ensure accuracy. Payroll records should be reconciled against bank accounts, employee timesheets and other employee records to make sure everything matches up and there are no discrepancies. Regular audits can also help uncover any potential issues before they become a problem.

Overall, accuracy is essential when it comes to payroll. Companies should take the necessary steps to ensure their payroll systems and processes are up-to-date and working properly to avoid mistakes and potential penalties.

The importance of customer service

Customer service is a key component of any payroll system, and it’s especially important for small businesses. If there are ever any issues or misunderstandings with payslips or taxes, having someone available to quickly address them can save a lot of time and stress. A dedicated customer service representative who knows the ins and outs of the payroll system can help with any payroll-related inquiries, provide assistance in navigating the software and make sure the company is up to date with all regulations. They can also help with training new employees on how to use the system and answer any general payroll questions. Having a helpful customer service representative on staff can go a long way towards making sure that payroll runs smoothly and efficiently.

Conclusion

Small businesses have unique payroll challenges when it comes to managing their in-house payroll. While speed, compliance, accuracy, and customer service are all important, it is also important to keep up with the ever-changing regulations and laws that may affect your payroll process. A good way to stay ahead of any potential issues is to hire a payroll company that can provide the necessary services. It is also important to be aware of the potential risks that come with managing payroll internally. By understanding these risks and taking proactive steps to mitigate them, you can ensure that your payroll process runs smoothly and efficiently. If your business cant afford to have inhouse or outsrouce its payroll requirements, Use our website and use our pay as you go service to order payslips online