Payroll Service and Work Around It

Why do you need payroll service

Your business need payroll service if your business has employees that are paid £123 or more a week or get expenses and benefits. Does any of your employee have another job or receives a pension?

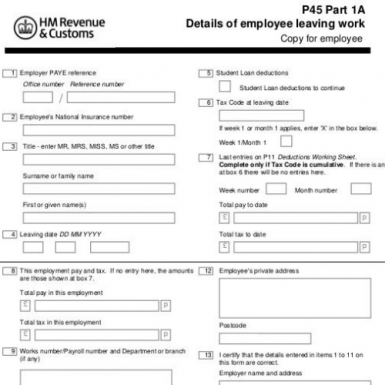

If the answer to any of the above question is ‘Yes’, then as an employer you will have to register your company for PAYE as part of running payroll for your employees. PAYE is a process through which HMRC collect the tax and national insurance contribution from a business on behalf of the employees.

What is involved in running payroll

As part of running payroll, the payroll company will need to perform certain tasks each month. Normally the tax runs from the 6th of month to the 5th of next month. At the time of running the payroll compute deductions by recording your employees’ monthly salary in your payroll software, even if their salary is less than £123 a week.

Types of Taxable Income

Other types of taxable pay include Statutory pay (Statutory Sick Pay (SSP), Statutory Pay for Parents, Maternity Pay, Paternity Pay, Adoption Pay, Parental Bereavement Pay, Shared Parental Pay

If your business employees receive Tips directly paid in the business bank account or into the business till, it is classified as normal pay and should be computed to deductible tax just like normal pay. Other payments like bonuses, commission, holiday pay, payments for time your employee have spent travelling, medical suspension payments that are given to a suspended employee because of health reasons, maternity suspension payments that are given to an employee because for her, or her baby’s, health, office holders’ payments (honoraria), cash prizes. To summarize any type of income that an employee receive is considered as normal taxable pay.

Calculating Deductions

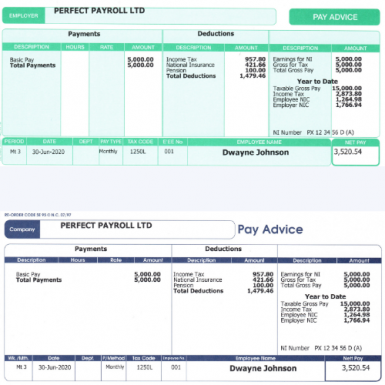

Your payroll company must calculate the amount of income tax and National Insurance is due to HMRC from the employees’ pay. These deductions are calculated based on employee’s gross pay, tax code and National Insurance number.

To finalise the correct amount other deductions like student loan repayments, pension contributions, Payroll Giving donations and child maintenance payments also need to be considered.

Student loan repayments must be deducted and computed. A student loan is repaid based on the following:

- Plan 1 - 9% of employee income above £20,195 a year

- Plan 2 - 9% of employee income above £27,295 a year

- Plan 4 - 9% of their income above £25,375 a year

- Postgraduate loans - 6% of employee income above £21,000 a year Pensions

Pension deductions – This type of deduction is done before the income tax is calculated and deducted. Make sure to perform these deductions after the National Insurance is taken off.

In addition to above employer is also responsible to pay employer contributions into business employee’s pension. As per recent law all employers will have to pay into a workplace pension scheme for their employees - this is also known as automatic enrolment.

Tax on charity

An employee can decide to donate to charity directly from their pay before tax is deducted. However, the only way to do is by registering with Payroll Giving agency and to enrol with Payroll Giving scheme. As a good practice the payroll company should record these deductions and must keep the agency contract, employee authorisation forms and details of payments to the agency.

Child maintenance

For a paying parent the tax on child maintenance payments is still applicable in the UK. However, for a receiving parent, the child maintenance payments are not classified as taxable income. On employees request an employer may decide to deduct child maintenance payment directly from a paying parent’s salary or pension.

Conclusion

Running inhouse payroll and performing its tasks can be a very expensive, hectic, and complicated job. By law every business is responsible to submit correct information of taxable income to HMRC. Any mistakes can lead to heavy fines and liabilities and therefore to avoid any mistakes, and for smooth running of payroll, it is highly recommended to hire a reputable payroll company offering online payslip service.