The Benefits of Working with an Online Payroll Company - All You Need to Know!

The benefits of working with an online payroll company cannot be underestimated. It can save employers time, money, and hassle. With an online payroll company, employers can manage their payrolls remotely and securely, as well as stay on top of payroll taxes and other related duties. Companies can also outsource the payroll process to an online payroll company, meaning that they can focus on other business operations instead of dealing with the complexities of payroll. This article will provide an overview of the benefits of working with an online payroll company, and all that you need to know to make an informed decision.

What is an Online Payroll Company?

Online payroll companies offer payroll and HR administration services for employers and HR practitioners. They provide a wide range of services, including calculating and disbursing payroll, tax filing and payment, employee onboarding, and other related HR services such as employee management, time tracking, and more. Online payroll companies let employers manage all aspects of their payrolls securely and remotely, and they may also provide other services such as employee self-service, a mobile app, and HR software.

Benefits of Working with an Online Payroll Company

As mentioned, there are a number of benefits of working with an online payroll company. Here are some of the most important ones: - Time saving - When you’re managing your payroll in-house, there is a chance that you will miss a deadline, or be late with filing taxes. This can cause a lot of stress and could lead to penalties. With an online payroll company, you can be sure that your payroll is accurately processed and filed on time, while meeting all state and federal laws. - Money saving - Employers often spend £2,000 or more on payroll processing, taxes, and insurance each year. You will have to pay for these services whether or not you have an in-house payroll system, so they’re an expense that you’ll have to cover. However, when you work with an online payroll company, these expenses are covered by the service fee. - Hassle-free - Managing your payroll in-house means that you need to deal with a lot of complexities, such as calculating gross pay, deductions, and filing taxes. There are many laws that govern the payroll process, and employers who don’t comply with them can face penalties. Working with an online payroll company eliminates all of these hassles, so you can concentrate on more important things.

Types of Online Payroll Companies

There are many types of online payroll companies. Full service payroll companies offer everything employers need to manage payrolls, including software that covers employee onboarding, time tracking, payroll, tax filing, and HR administration. Payroll only companies offer payroll processing only, without other HR and administrative services. Contract payroll companies provide a limited set of services such as processing payroll, tax filing and payment, and employee onboarding. They don't provide any software or other HR administration services.

How to Choose an Online Payroll Company

It can be difficult to identify the best payroll company for your business when there are so many options available. The most important thing to consider when choosing an online payroll service is to look for a company that offers fast and secure payroll processing. It will ensure that all employees receive their wages on time and that their data is protected. As well as speed and security, you should make sure that the payroll service you choose offers features tailored to your needs, such as the ability to generate wage slips online. They may also offer payroll tax calculation, direct deposit, and employee self-service portals, among other services. Additionally, you'll want to compare the prices of the different services. While cheaper isn't always better, you shouldn't pay more than necessary. You should compare the plans offered by various companies before choosing one. In the end, finding an online payroll company doesn't have to be a complicated process. Just consider the factors outlined above, and you should be able to find one that fits your needs and budget.

Tips for Working with an Online Payroll Company

Due to affodability and ease of use many businesses choose to hire an online payroll company. Without a doubt it is a convenient and cost-effective way to manage payroll, but it is equally important to understand risks and challenges and what process you should adopt when working with an online payroll company.

Making sure that you are going to work with a reputable company is a must. Check online and offline reviews. Ask the payroll company to allow you to reach its existing customer to collect review on their services. This is the only way you can make sure that the company you are hiring is credible, trustworthy and has required experience in dealing with payroll complexities.

Make sure that the online payroll company you choose is using secure technologies and not doing payroll manually. Look for companies that offer secure encryption of data to protect your business information.

Be aware of the contracts small prints or any hidden fees associated with using an online payroll company. Make sure that you shop around and get the best value for your money and read the fine print before signing any long term contract.

I would make sure that there is clear and transparent communication with the online payroll company. Ask questions if you don’t understand something and ensure that your payments are being handled correctly.

Finally, check for customer support. The best online payroll companies will provide good customer service and be able to help with any issues that arise.

Using an online payroll company can be a great way to manage your business’s payroll, as long as you take the time to do your research and make sure that you are working with a reputable company. By following these tips, you can ensure that your payroll will be handled securely and accurately.

Key Takeaways

An online payroll company provides payroll and HR administration services for employers, including calculating and disbursing payroll, tax filing and payment, employee onboarding, and other HR services. When choosing a company, make sure it is state-compliant, has easy-to-use software, and has transparent fees. Make sure the company is available when you need them, and request a trial run to get a better idea of how they work. Finally, follow up with references and read online reviews to get a better idea of how the company operates.

How Regulated UK Payroll Companies Protect Employees' Privacy with Payslips

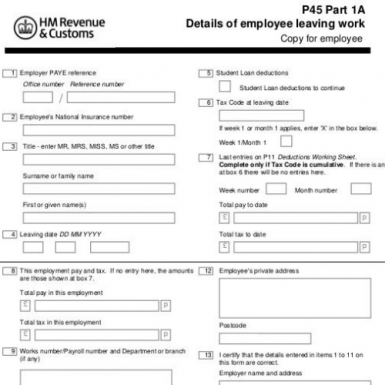

Payroll companies are crucial for the smooth functioning of any organization. They are responsible for making sure that employees are paid on time and accurately. However, as personal information such as salary and tax details are involved, it is important to know whether these companies are regulated. In the UK, payroll companies are regulated, which provides assurance that employees' privacy and data protection rights are protected. In this article, we will explore how regulated UK payroll companies ensure the privacy of employees' payslips and P60s.

What are Payroll Companies and Their Role in Employee Paychecks?

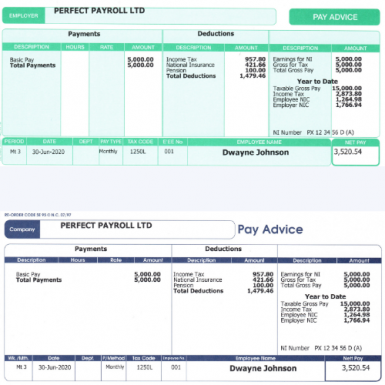

Managing employee paychecks requires payroll companies to calculate employee pay based on their salary, hours worked, and other factors such as taxes and pension obligations.

Additionally, payroll companies ensure that their employees are paid accurately and on time, adhering to employment regulations. Business owners are freed up to focus on running their business and not worry about payroll administration.Payroll companies use specialized software to manage employee data and ensure that they are paid accurately and on time. They also issue payslips to employees, which provide detailed information about their pay and deductions.

With the rise of digital technologies, payroll companies are able to offer employees and employers a more streamlined and efficient process for managing payroll. This includes online portals where employees can access their payslips and view their payroll information at any time.

Overall, payroll companies play a vital role in ensuring that employees are paid correctly and on time, while also helping businesses stay compliant with employment regulations. By outsourcing payroll management to a reputable payroll company, employers can save time, money and focus on growing their business.

Are Payroll Companies Regulated in the UK?

Yes, payroll companies in the UK are regulated. Regulations and laws that govern payroll companies ensure that employees are paid on time, that taxes are paid correctly, and that employees' privacy is protected. As an example, the vast majority of payroll companies in the UK are registered and regulated by the Information Commissioner's Office (ICO) and the UK's equivalent to the Internal Revenue Service, HM Revenue & Customs (HMRC).

The ICO's responsibility includes the enforcement of the General Data Protection Regulation (GDPR) which is designed to protect the privacy of individuals and their personal data. This includes payroll information and the employees' paystubs which contain sensitive personal information such as salary and tax information. This means that a payroll company has to comply with the GDPR in order to ensure that the personal information of their employees is being processed in accordance with the GDPR, in order to protect the employee's privacy.

HMRC are the enforcement division of the HM Revenue & Customs. As the frontline regulators, HMRC ensures employers and payroll companies comply with tax laws such as PAYE and making sure employees tax contributions are calculated correctly and paid to HMRC on time.It's important to note that not all payroll companies are regulated in the same way. Some payroll companies may be registered with specific professional bodies or have voluntary accreditation schemes in place. However, all payroll companies are obliged to abide by laws, regardless of their classification.

That is to say, payroll companies in the UK are regulated in order to guarantee that employees receive their wages on time, that their taxes are calculated correctly, and that their privacy is protected. It is best for employers to hire a payroll company that is regulated to protect them from penalties and keep their employees happy.

Regulations and Laws that Protect Employees' Privacy with Delivery Of Online Payslips

In the UK, there are strict regulations and laws in place that require employers to provide employees with payslips that adhere to specific standards. This is important for the protection of employees' privacy and the prevention of any unauthorized access to their personal information.

Under the Employment Rights Act 1996, employers are required to provide employees with payslips that show the gross amount of wages earned, the amount of any deductions made, and the net amount of pay received. Additionally, the Data Protection Act 2018 requires employers to ensure that employees' personal data is handled appropriately and securely, including any information contained on payslips.

Furthermore, the General Data Protection Regulation (GDPR) introduced in May 2018 strengthened the rights of employees regarding their personal data, including their right to access their payslips and request corrections if necessary. Employers must ensure that any data collected and processed on payslips is compliant with the GDPR.

Compliance with these regulations and laws is crucial for payroll companies to maintain their reputation and the trust of their clients and employees. Failure to comply could result in penalties and legal action taken against the company.

In summary, the UK has strong regulations and laws in place to protect employees' privacy and personal information on payslips. Payroll companies must ensure that they are compliant with these regulations to provide secure and confidential services to their clients. By partnering with a regulated payroll company, employers can rest assured that their employees' personal data is protected and handled appropriately.

Why Compliance with Regulations is Crucial for UK Payroll Companies?

A UK payroll company must comply with regulations to protect the privacy of its employees and avoid legal consequences. Failure to comply with regulations can result in hefty fines, legal action, and reputational damage.

Payroll companies must comply with the General Data Protection Regulation (GDPR) and the Employment Rights Act. According to the GDPR, personal information, including payslips, must be processed lawfully, fairly, and transparently. A written statement of pay and deductions, including an employee's salary and any deductions, is required by the Employment Rights Act.

It is important for companies to comply with these regulations so that employees have access to accurate and transparent information about their pay and deductions. Furthermore, it shows that the payroll company adheres to ethical and responsible business practices.

Moreover, non-compliance with regulations can damage the reputation of the payroll company. In the age of social media, negative reviews and comments can spread quickly, causing irreparable damage to a company's reputation.

The UK's new employment law requires employers to stay up to date and make their systems and procedures comply with new regulations. They must also make sure to train employees and update their policies and procedures.

If a UK payroll company follows the law and is diligent, they will be rewarded with good safety and laws. However, by refusing to follow the law, companies put their employees at risk as well. Employees and employers alike need to choose a payroll company that won't bend the law.

Measures UK Payroll Companies Take to Ensure Confidentiality of Payslips

UK Payroll companies are required to adhere to strict guidelines to protect the privacy and confidentiality of their clients' payroll data. These measures are in place to prevent any unauthorized access or disclosure of sensitive information. Here are some of the steps that regulated UK payroll companies take to ensure the security of their clients' payslips:

1. Secure Data Management Systems

Regulated UK payroll companies utilize secure data management systems to ensure the protection of sensitive data. These systems are designed to encrypt and safeguard all payroll information to prevent unauthorized access by third parties.

2. Employee Authentication Protocols

Regulated payroll companies require employees to use unique login credentials to access their payroll information. This ensures that only authorized individuals have access to the data.

3. Limiting Access to Payslips

Payroll companies restrict access to payslips to only authorized personnel. This helps to prevent accidental disclosures of confidential information. Employees' personal information and payslip data are only shared with the relevant authorities for lawful purposes.

4. Electronic Delivery of Payslips

Regulated payroll companies deliver payslips electronically, reducing the risk of physical documents being lost or stolen. Employees can access their payslips on a secure platform that is password-protected and accessible only to them.

5. Ongoing Employee Education

Regulated payroll companies regularly educate their employees on the importance of confidentiality and data protection. Employees receive training on best practices for maintaining the privacy and security of payroll information.

By following these measures, UK payroll companies ensure the security and confidentiality of their clients' payroll data. Compliance with these regulations is essential to avoid penalties and reputational damage that may arise from breaches of data protection regulations. As a result, using a regulated UK payroll company ensures that both employers and employees can have peace of mind, knowing that their data is protected.

Benefits of Using a Regulated UK Payroll Company for Employers and Employees

Using a regulated UK payroll company has numerous benefits for both employers and employees. Here are some of the advantages of working with a regulated payroll provider:

1. Saves time and resources: By outsourcing payroll processing to a reputable payroll company, employers can free up time and resources that can be used to focus on core business operations.

2. Accurate payroll calculations: Payroll companies use advanced software to calculate payroll accurately, minimizing errors and reducing the risk of costly compliance issues.

3. Compliance with regulations: A regulated payroll company ensures compliance with all payroll and employment laws, reducing the risk of penalties or legal issues.

4. Data security: A regulated payroll company will implement strict security measures to protect sensitive employee data and prevent any unauthorized access.

5. Cost-effective: Payroll companies can offer competitive rates for their services, saving businesses money on administrative costs associated with managing payroll in-house.

1. On-time and accurate payments: Working with a reputable payroll company ensures employees receive their payments on time and with the correct amount.

2. Confidentiality of information: A regulated payroll company takes measures to safeguard the privacy of employee information, ensuring sensitive data is kept confidential.

3. Transparency: Payroll companies provide detailed payslips, outlining deductions, taxes, and other deductions, allowing employees to have a clear understanding of their pay.

4. Access to support: Employees can access support from the payroll company to resolve any queries or issues related to their pay.

Overall, using a regulated UK payroll company offers peace of mind to both employers and employees, knowing that their payroll operations are compliant and handled professionally.

Conclusion

In conclusion, payroll companies play an important role in ensuring employees receive accurate and timely paychecks. While payroll companies are not currently regulated in the UK, there are regulations and laws in place that protect employees' privacy with their payslips. It is crucial for payroll companies to comply with these regulations to protect employee privacy and avoid penalties. Regulated UK payroll companies take measures to ensure the confidentiality of payslips, including secure storage and restricted access to employee information. Using a regulated payroll company offers numerous benefits for both employers and employees, including increased efficiency, accuracy, and compliance. By choosing a reputable and regulated UK payroll company, employers can provide their employees with a reliable and secure payroll service.