Understanding Payslips and P60s for Your Business

As an employer, it’s important to understand the difference between payslips and P60s. These documents inform employees of their earnings and deductions from their salary, as well as provide evidence of their income for the tax year. In this blog post, we will take a look at what these documents are, how they differ, and why they're important to businesses.

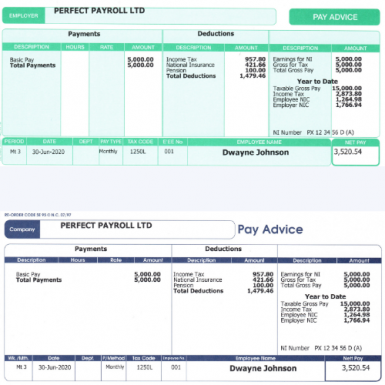

What is a Payslip?

A payslip is a document sent to employees each month that outlines the amount of money they have earned in that period and any deductions taken out of their wages. It also includes information such as the employee's name, job title, rate of pay and national insurance number. Employers must provide payslips to all full-time permanent staff members who are eligible for the national minimum wage or living wage. It is also good practice for employers to provide payslips to casual or part-time staff members too.

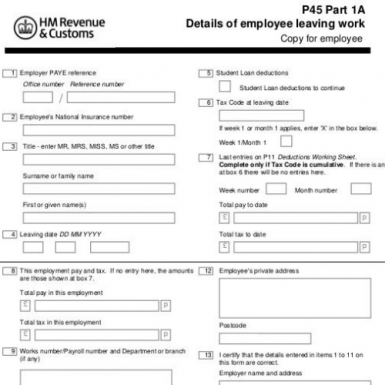

What is a P60?

A P60 is an annual summary document issued by employers at the end of each financial year (April 5th). It provides information about an employee’s total earnings and deductions over that year. This can include any taxable benefits (such as company cars) received by the employee during that time period as well as any income tax paid on those benefits. The document also outlines any national insurance contributions paid by both the employer and employee over the course of the year. It is important for employers to make sure all employees receive a P60 before April 6th each year so that they can accurately complete their tax return.

How Are They Different?

The key difference between payslips and P60s is timing - payslips are issued every month while P60s are issued yearly. Additionally, payslips contain more detailed information about individual payments than P60s do - such as overtime payments or holiday pay - while P60s include more comprehensive information about overall earnings including taxable benefits received over the course of the financial year. Finally, while both documents include deductions taken from salaries, only P60s outline how much has been paid in national insurance contributions over that period of time.

Conclusion

A business's payroll system should be organized in such a way that it produces accurate payslips on time every month and timely issuance of accurate P60 forms at year-end.. The importance of these documents cannot be understated; they not only show how much an employee has earned but also provide evidence if required when completing tax returns or other official paperwork related to employment status or other matters governing employment relationships with HMRC or other governmental bodies such as Companies House etc.. Taking control over your payroll will ensure you manage your HR department efficiently, create motivated employees with accurate records which help protect your business from potential litigation due to incorrect record keeping when it comes to paying staff correctly now or in future years.. This ensures everyone involved receives exactly what they are entitled to in accordance with current legislation ensuring compliance with HMRC regulations regarding taxation etc... To summarize; understanding payslips & p60’s help businesses manage their HR department efficiently & aid in protecting them from potential litigation due to incorrect record keeping when it comes to paying staff correctly now & in future years whilst meeting HMRC requirements regarding taxation etc... As always if you need assistance understanding these matters then speak with your accountant who can advise you further on these matters....The above article was intended solely for informational purposes & should not be taken as advice from professional advisors.....Happy Reading!