Understanding the Basics of Payslips and Payroll

Knowing how to properly manage payslips and payroll for your business is essential. It’s the process of accurately recording the wages paid to each employee and ensuring that employees are paid their due wages on time. Payroll is a critical component of any business’s financial management. At its core, payroll is the process of calculating and disbursing wages to employees in exchange for their work. To ensure that this process is done accurately and efficiently, businesses must understand the importance of payslips and payroll. Let’s break down why these two elements work hand-in-hand to create a successful payroll system.point.

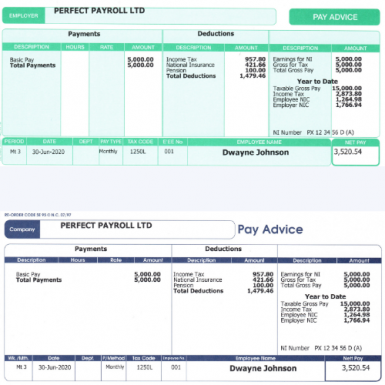

What Is a Payslip?

A payslip is a detailed record of an employee’s gross salary, deductions, taxes, benefits, allowances, net pay, and more. This document serves as proof that your business has made all necessary payments to the employee for their work rendered. In many countries, it is legally mandated that all employers provide payslips to their employees.

Payslips are also incredibly important for tracking employee data such as hours worked, shifts completed, overtime hours earned, bonuses received, deductions taken from salary (such as health insurance premiums), etc. By having comprehensive records of employee information such as this on file in easily accessible documents like payslips, businesses can avoid any potential discrepancies between what employees were expecting versus what they actually received their salary in exchange for their work.

Understanding Payroll

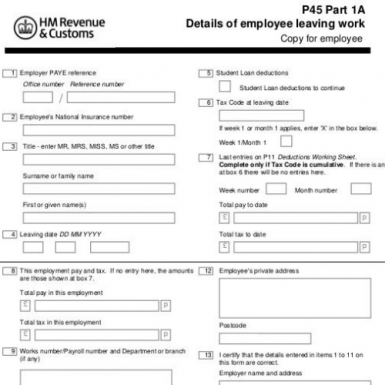

Payroll refers to the process of calculating wages owed to each employee based on their hours worked and other factors (overtime pay rate; regular pay rate; tax deductions; benefits expenses). It also includes issuing payments in exchange for those wages; this includes distributing physical or digital checks or bank transfers if applicable. When done correctly and efficiently, payroll should be able to accurately calculate each employee’s take-home pay after taxes are deducted from the gross amount due them for their services rendered.

In addition to ensuring accurate calculations and payments being issued promptly and accurately on time every month/week/pay period (depending on company policy), payroll also ensures compliance with local labor laws and regulations regarding payment remittance timing requirements or benefit entitlements or deductions taken out of wages such as health insurance premiums or pension contributions. Payroll departments are responsible for ensuring that these laws are adhered to properly by all parties involved in order to protect both employers and employees alike from any potential legal issues down the road.

Conclusion

Payslips and payroll go hand-in-hand when it comes to managing a business's finances successfully. As employers, it is essential that you understand the importance of providing accurate payslips so that your employees have clear records of their income earned as well as any deductions taken out from it; this protects everyone from potential legal issues further down the road if there ever were any discrepancies between what was expected versus what was actually paid out in wages for services rendered. Furthermore, understanding how payroll systems operate will help ensure compliance with local labor laws governing payment remittance timing requirements or benefit entitlements or deductions taken out of wages such as health insurance premiums or pension contributions—allowing you peace of mind knowing your business's financials are handled correctly at all times!