What is a P45 and How Can It Help You Get a Tax Refund?

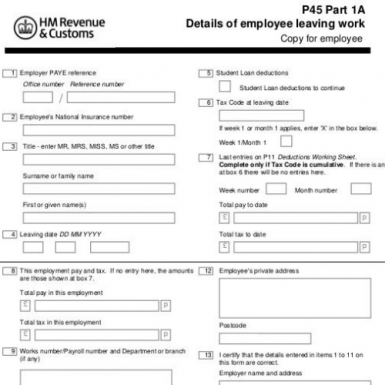

A P45 is an important document used by employers to inform HMRC (Her Majesty’s Revenue and Customs) of their employees' income and tax deductions. This document is essential for businesses, as it allows them to calculate the right amount of tax that an employee should pay and helps them get a refund if they have overpaid. In this article, we will discuss how businesses can use the P45 to get a tax refund.

How the P45 Works

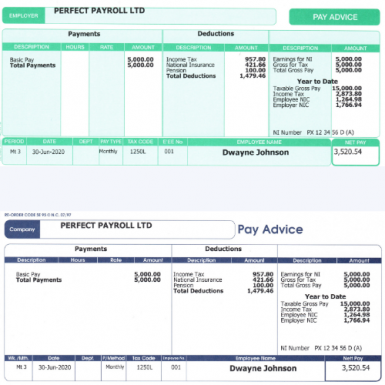

The P45 provides the details of an employee’s income and deductions for the last tax year. It consists of four parts – Part 1A, Part 1B, Part 2 and Part 3. The first three parts are filled in by the employer when the employee leaves their job or at the end of each financial year. Part 4 is given to the employee so that they can keep it for future reference.

Using the P45 to Get a Tax Refund

By using the information from their P45, businesses can check whether they have paid too much tax during the previous financial year. If this is indeed the case, then they can apply for a refund by sending a completed self-assessment form to HMRC along with their P45 documents. Once HMRC verifies all documents, they will issue a refund within 15 working days.

Tips on Using Your P45 Effectively

To make sure you get your tax refund efficiently and quickly, it is important that you provide accurate information on your self-assessment form. This includes your name, address and other relevant information such as National Insurance number or Unique Taxpayer Reference number (UTR). It is also important to provide evidence such as proof of earnings and any other relevant documents that may be needed by HMRC in order to verify your claim. Finally, make sure that you keep copies of all documents sent to HMRC in case there are any issues with your application or if you need to submit additional evidence later down the line.

Conclusion

In conclusion, understanding how your business can effectively use its P45 documents to get a tax refund can help ensure that you are not paying too much in taxes each year and help you save money in the long run. By providing accurate information on your self-assessment form along with relevant documents such as proof of earnings, businesses can be sure that their applications for refunds are processed quickly and efficiently by HMRC. Furthermore, it pays off to keep copies of all documents sent off just in case any issues arise concerning further evidence needed later down the line. Understanding how best to use your P45 documents can help ensure efficient taxation processes while helping you save money every financial year.