Choosing Payroll Services and Due Diligence

Business needs and objectives

The needs and objectives of a firm’s payroll should be at the heart of the payroll company. An employer should consider whether their current payroll services is appropriate in light of payroll needs and objectives and if not, the type of payroll services a new payroll company should offer.

Understanding your payroll management company

A payroll company should show their skills for example:

• their knowledge and experience within payroll industry;

• their number of clients;

• their payroll system, software, objectives; and

• the type, level and cost of the service they will offer in line with employers demands and needs.

Consider business payroll needs and objectives

When handing the payroll job to the payroll company an employer must set out a wide range of checklist that a payroll company must answer, where relevant, about the employee’s circumstances and objectives depending on the nature and extent of the service provided. Where an employer has existing payroll in place, the employer should collect necessary information to assess whether recruiting a new payroll company is going to be suitable and meets the business payroll needs and objectives.

We also believe a payroll company should collect information regarding the employers’ specific objectives rather than relying on generic objectives for the employer. For example, if generating an expensive secure sealed payslips for the company’s employee is an objective, A payroll company should identify the specific reason why the employer has this expensive requirement. Additional detail around the number of employees, payslip frequency, payslip requirement, including the type of information is required in the payslip, will help determine the suitability and estimating the workload cost.

Once payroll company’s advisers have established employer’s objectives and payroll priorities, they should typically help the employer understand how their payroll services will work for the business, the complexities, costs and prioritise employers objectives. A payroll company should approach this matter in a fair, confidential, and balanced way, in accordance with the business’s best interests. Our payroll consultant will never approach a fact-finding exercise with a preconceived agenda to switch the business existing payroll services with our services as this may not be the most suitable option for the client.

Customer Feedbacks

It is a good practice to ask for their existing customer feedback about their services. Several companies used feedback from our clients and identified that they only required a simple, low-cost payroll service. We used this feedback exercise to understand our client’s budget and requirement which helped us design simple monthly packages that provided a simple ongoing payroll service at a cost that was lower than the market average. In addition, we offer a pay as go services which help our new customer to kick start with our services using test and trial methodology.

Some payroll companies offer a discretionary service, but its replacement business cost comparison does not assess the overall impact of all the charges that may incur by recruiting a new payroll management company.

Information Gathering

It is a good practice for payroll firm to take detailed notes during the ‘fact-find’ meeting. Not only did these detail the employers specific payroll objectives, but also the underlying motivation behind the business objectives. By gathering this level of detail, the payroll company is in better position to demonstrate that its replacement payroll company recommendations meet the needs and objectives of the client’s business.

Poor practice

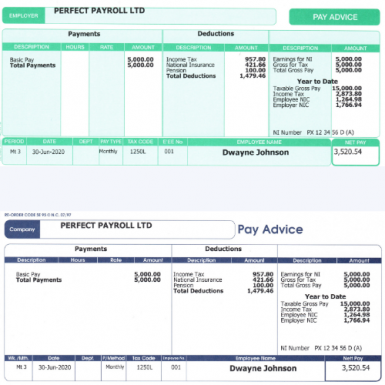

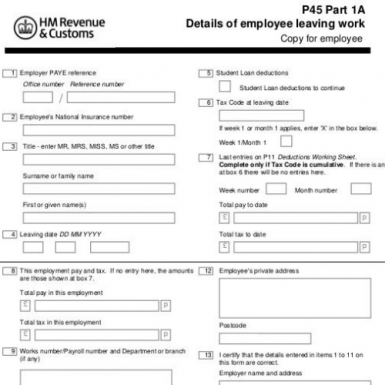

Generating a payslip with very little information. We have noticed payroll companies generating payslips without considering the employee start date which calculated the tax incorrectly and therefore wrong tax submissions to HMRC. This can lead to penalties being imposed on employer.

Generating Payslips Good practice

A payslip should be generated displaying YTD (Year to Tax Date). This is one of the most important information that every payslip should consist of. It helps both employee and employer understanding the amount of tax paid to HMRC. A payroll company should generate payslip with comprehensive detailed information, to the single penny detail information basis, including pension deduction etc.

Conclusion

Payroll service provider is responsible for deciding how they approach in giving flawless accurate service and for ensuring their payroll systems and controls are fit for purpose and effective in handling the business payroll needs and successful outcomes. We find generally that the effectiveness of any payroll company is down to its robust operation, structure, their team, and the services they provide.

Employer must consider the additional costs that may incur for replacing the payroll company and the potential benefits associated with that cost. Based on business requirements employers are likely to find such a recommendation suitable