Order P45 Online

What is a P45?

A P45 is a document that is issued by an employer to an employee when they leave their job. It provides important information about the individual’s income, National Insurance contributions and tax deductions. A P45 is also known as a ‘Leaving Certificate’ and includes the employee’s name, National Insurance number, the period of employment, tax code and other information such as student loan deductions. The P45 should be retained by the employee as it will be used when they start their next job. This document is very important for claiming tax refunds or for establishing a new employment record. Order P45 Online

What if I have lost P45?

Fortunately, it is possible to obtain a replacement P45. The process varies depending on the type of business you run. If you operate as a limited company or partnership, you need to contact HMRC for advice on getting a new P45. For sole traders, you should contact HMRC and explain the situation. They may ask for evidence such as payslips or other documentation from the period the employee worked for you.

Once you have requested a replacement P45, HMRC will assess your request and send out the relevant paperwork. You will then need to provide this to your employee as soon as possible so that they can complete their own tax affairs. Click and read more about how to get replacement p45 online

Can I get a duplicate P45?

If you've lost your P45 or it has been damaged, you can get a duplicate. To obtain a duplicate P45, contact your employer, or if you are no longer employed, order p45 online. Your employer should be able to give you a form P45 (Part 3) to take with you to HMRC. You may also need to provide proof of identity such as your passport or driving licence.

Once you receive the new P45, you should give it to your employer or potential employer to ensure that the correct amount of tax is deducted from your salary. If you have any questions about obtaining a duplicate P45 click to read more. Read more about how to get duplicate p45.

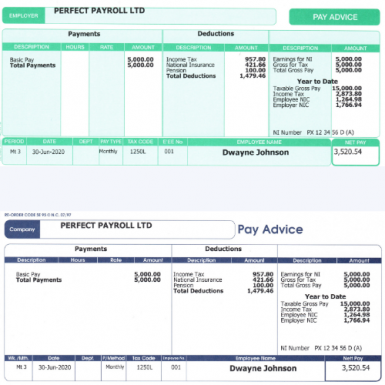

Overall, this website is a great tool for small businesses who need help managing their P45 online quickly and accurately. Employers can rest assured that our payroll operations are compliant with all relevant regulations and that their employees will receive the accurate payment and documentation they need.

We also offer support with submitting online tax forms such as PAYE and CIS Returns. By using our services, employers can ensure that they are in compliance with HMRC’s PAYE regulations and always have up-to-date information about their payroll obligations.|

In addition to above if can be very frustrating If you have lost your P60 and needed a replacement p60 without the knowledge of how to track down a copy. Fortunately, at get payslips we offer to generate P60 and Payslip Online. As the name suggests, we allow you to generate and get your payslip online within 30 minutes, anytime, anywhere. You don't need to worry about losing your P60 or finding a replacement copy. Payslip Online has you covered. Once you have placed an order, you dowload a copy of your P60 or your online payslip by logging in to your account and look for the section that has your order number. From there, you can easily download an e-payslip or you can print a copy of your P60 and payslip.