7 Times You'll Need a Payslip (And How to Get One)

Do you ever find yourself needing a payslip, but not knowing how to get one? Whether you're applying

for a loan, filing taxes, or settling a dispute with your employer, having the right payslip can make the process easier. In this blog post, we'll explain seven times when you might need a payslip, and how you can get one. From online payslips to replacement payslips, we'll cover all the bases so you know exactly what to do if you ever find yourself needing a payslip.

1) When You Start a New Job

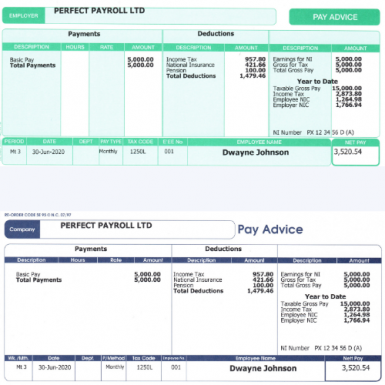

When you start a new job, you'll need to provide your employer with a payslip in order to prove your income and confirm your hours. A payslip is a document from an employer that provides a record of how much money you've been paid. It shows the amount of gross pay you received, along with taxes and deductions taken out.

Getting your first payslip can be daunting, especially if you're not sure what it should look like or where to get one. Luckily, there are a few different ways you can obtain a payslip when starting a new job.

One way is to contact your employer directly and request one. Your employer should provide you with your first payslip shortly after your start date. You can also ask your employer to provide you with a copy of your payslip electronically. This is becoming more and more common, as employers recognize the convenience and efficiency of electronic payslips.

If your employer doesn't offer electronic payslips or is unable to provide you with a hard copy, there are other options available. You can order replacement or fake payslips online from a number of trusted companies that specialize in creating authentic-looking documents. These services often offer fast turnaround times and secure payment options, so you can rest assured that your payslip will arrive in time for whatever purpose you need it for.

By getting your first payslip when starting a new job, you can ensure that all your personal and financial information is accurate and up-to-date. This is important for keeping track of your earnings and deductions, as well as filing taxes correctly. So don't forget to get your payslip before starting your new job – it's essential!

2) When You're Applying for a Mortgage

One of the most important documents you’ll need to provide when you apply for a mortgage is your payslip. A payslip shows your employer has paid you, and also how much you make. This helps mortgage lenders determine if you can handle the payments associated with the loan you’re applying for.

If you don’t have a current payslip, don’t panic – there are options. You can request a replacement from your employer, usually for a small fee. You may also be able to get a copy from your payroll department or from your bank. If you quit or lost your job, you can order a copy of your payslip from the government for a fee.

In addition to your payslip, you’ll also need to provide other documents as part of the mortgage application process, such as proof of income, bank statements, and tax returns. Make sure you have all of these items ready to go before you begin the application process so you can make it as smooth and seamless as possible.

3) When You're Applying for a Loan

When you're applying for a loan, the lender will likely require you to provide proof of income in the form of a payslip. The lender will use the information from your payslip to assess your ability to repay the loan. This means that providing a payslip is essential if you want to be approved for a loan.

Fortunately, if you don't have an official payslip, there are several options available to you. Depending on your employer, you may be able to access and download your current or past payslips online. If this isn't possible, you can request a replacement payslip from your employer or you can order one from a third-party provider.

It's important to keep in mind that most lenders require an official payslip, so it's best to obtain one from your employer whenever possible. This will help ensure that the lender has accurate information when assessing your loan application.

4) When You're Applying for Government Benefits

When applying for certain government benefits, like disability or family assistance, you may be asked to provide a payslip. In order to qualify for some benefits, you'll need to show that you have a steady income, which is why a payslip can be an important document.

If you're currently employed, your employer should be able to provide a payslip as proof of your income. However, if you don't have access to your payslip, there are other options available.

For example, you can order a replacement payslip from your former employer. They'll usually charge a small fee for the document. Alternatively, you can use an online payslip service, which will generate a payslip for a fee.

Regardless of how you get it, having a payslip handy when applying for government benefits can save you time and energy in the application process. Make sure you keep it in a safe place and update it with your latest income information when needed.

5) When a business is Filing Taxes for their employees

Filing your taxes can be stressful, and it's important to make sure you have all the information you need before submitting your returns. One of the key pieces of paperwork an employer need is a employee payslip. Employee payslip is a document that shows how much net amount an employee has earned and how much tax a business is due to HMRC after any deductions taken out of employee wages.

Employee payslip contains information such as your gross pay, any deductions for taxes or other benefits, and your net pay. Having this information on hand can help ensure bsiness file accurate tax returns.

If you're self-employed or work for a small business that doesn't provide payslips, you can still get an official document to use when filing your taxes. You can order a replacement payslip from a third-party provider or create a self service payslip with the appropriate information.

No matter which option you choose, make sure the information provided is correct so you don't end up in trouble with the HMRC. If you're not sure if the payslip you have is valid, it's best to contact your employer or the third-party provider to double check before filing your taxes.

6) When You're Changing Your Name

If you are thninking of changing your name for any obvious reason, you may use your payslip as proof of name identity. This can be especially important if you’re applying for a new passport, driver’s license, or other documents that require proof of identification.

Since your name change isn’t reflected on your most recent wage slip, getting a payslip with a new name in this situation can be tricky. To avoid any complexity It is best to get a replacement payslip from an online payslip companies.

For a replacement payslip, you can also contact your former employer and request a copy of your original payslip with your new name on it. It’s important to make sure that the payslip you receive is accurate and reflects your current name and information.

Replacement payslips can also be ordered online and obtained quickly. You can get a duplicate payslip that includes your name change details or order a genuine payslip directly from one of the reputable payroll company.

Regardless of which option you choose, it’s important to make sure that the payslip you present when applying for identity documents reflects your current name and information. With the right payslip in hand, you can rest assured that you have the proof of identity you need to complete your name change process.

7) When You Quit or Lose Your Job

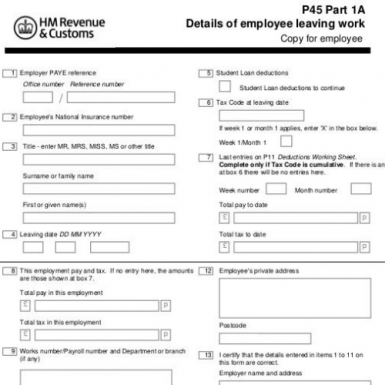

If you quit your job or are laid off, it's important to make sure you have a copy of your most recent payslip for future reference. This is especially true if you plan to apply for unemployment benefits. Your payslip will provide important information about the wages you earned in the past and can be used to verify your income.

In most cases, you should be able to access an electronic copy of your payslip through your employer's payroll system. However, if your employer no longer has access to the system, you may need to order a replacement payslip. You can do this by contacting your former employer directly or seeking out a professional service that specializes in providing replacement payslips.

Alternatively, if you're unable to get an official replacement payslip, you may be able to generate payslip online that can be used for certain purposes. These documents typically provide basic details about your income, such as how much you earned and when it was paid. Keep in mind, however, that fake payslips are not legally valid forms of proof of income and should only be used in cases where an official document is not required.

Conclusion

Payslips are an important document for many different aspects of life. They are used to verify your employment and can help you when you’re applying for a loan or mortgage, filing your taxes, or changing your name. It is important to keep all your payslips in a safe place and if you lose them, there are ways to replace them. You may also need to get a payslip when you start a new job or when you leave a job. Keeping track of your payslips is essential so make sure you have copies stored away for whenever you may need them.