Budgeting Tips to Keep Your Mortgage Payments under Control Even on a Reduced Salary

You're not alone in experiencing an uncertain financial future due to rising living costs. Your paychecks are also affected. The challenge of controlling mortgage payments is something many people face today. With a lower salary, you can still meet your mortgage payments by managing your expenses and budgeting well.

Evaluate your financial situation

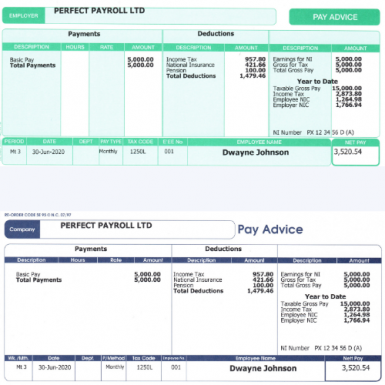

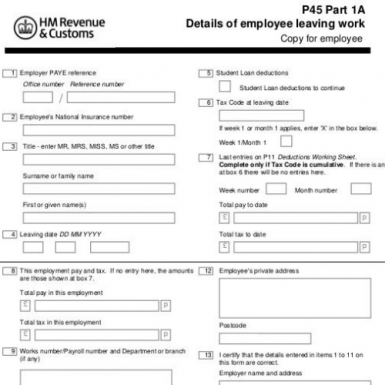

The first step in tackling an increase in mortgage payments is to evaluate your current financial situation. This means taking a closer look at your income, expenses, and overall budget. You may want to start by reviewing your latest bank statements, pay stubs, and other financial documents to get a clearer picture of where your money is going.

One important factor to consider is whether you have experienced a reduction in your income. If you have lost your job, had your hours cut, or experienced a reduction in pay, it may be time to reevaluate your budget and make some adjustments to ensure you can keep up with your mortgage payments.

Additionally, you may want to take a closer look at any outstanding debts or other financial obligations you have. This could include credit card balances, car loans, student loans, or other expenses that are eating away at your budget. By getting a better understanding of your overall financial picture, you can start to identify areas where you may be able to cut back and free up some extra cash.

Once you have a better understanding of your financial situation, you can start to develop a plan for keeping your mortgage payments under control. This may involve cutting back on expenses, finding ways to increase your income, or exploring government programs and resources that can help you stay afloat during tough times. Whatever your approach, taking the time to evaluate your financial situation is the first step in taking control of your mortgage payments and securing your financial future.

Revisit your budget

Once you've taken stock of your financial situation, it's important to reassess your budget. Your budget will play a critical role in ensuring that you can make your mortgage payments without stretching yourself too thin.

If you're dealing with reduced income, it may be time to trim some of your expenses. Take a look at your current spending habits and identify areas where you can cut back. Consider cancelling subscription services, reducing eating out expenses, and avoiding unnecessary shopping.

Also, try to build a buffer into your budget in case of emergencies or unforeseen expenses. Setting aside even a small amount each month can give you peace of mind and help you avoid scrambling to find extra funds if you're faced with an unexpected expense.

Once you've identified where you can reduce expenses and have built in some wiggle room, it's time to rework your budget to prioritize your mortgage payments. You may need to make some tough decisions and cut back on other expenses to ensure that your mortgage payments are made in full and on time.

Ultimately, revisiting your budget is a key step in keeping your mortgage payments under control during a period of reduced income. It may require some sacrifices, but it will give you peace of mind and ensure that you're able to stay on top of your mortgage obligations.

Consider refinancing or renegotiating your mortgage

Refinancing or renegotiating your mortgage can be a viable option to keep your mortgage payments under control. Refinancing involves replacing your existing mortgage with a new one that has a lower interest rate and better terms, which can lead to lower monthly payments. Renegotiating your mortgage, on the other hand, involves negotiating with your lender to change the terms of your existing mortgage, such as extending the repayment period, changing the interest rate, or switching to a different type of mortgage.

Before you decide to refinance or renegotiate your mortgage, make sure to consider the costs involved, such as appraisal fees, closing costs, and prepayment penalties. You should also compare the interest rates and terms offered by different lenders to find the best deal.

Refinancing or renegotiating your mortgage may not be suitable for everyone, but it can be a worthwhile option if it can help you save money in the long run. It is important to weigh the pros and cons and seek professional advice before making a decision.

Look for ways to increase your income

Another strategy to tackle an increase in mortgage payments is to look for ways to increase your income. You can start by considering whether you can take on more hours at work or if there are any opportunities for a promotion or a raise. Alternatively, you can consider a part-time job or freelancing gig to supplement your income.

You may also want to explore passive income streams such as renting out a spare room on Airbnb or creating and selling digital products. The key is to find an opportunity that aligns with your skills, interests, and schedule.

Remember that every dollar you earn can help reduce your financial burden and keep your mortgage payments under control. By taking a proactive approach and seeking out ways to increase your income, you can not only make your mortgage payments more manageable, but also improve your overall financial health.

Cut down on expenses

Reducing your expenses is one of the most effective ways to keep your mortgage payments under control. To start, take a look at your monthly expenses and see which ones you can eliminate or cut down on. Here are some tips to get you started:

1. Cut back on eating out: Eating out can be expensive. Consider cooking meals at home more often and packing your lunch for work. This can save you a lot of money in the long run.

2. Reduce your entertainment budget: Instead of going out to movies or concerts, try hosting a movie night at home with friends or family. You can also take advantage of free events in your community.

3. Use public transportation: If you live in an area with reliable public transportation, consider using it instead of driving your car. This can save you money on gas, car maintenance, and parking.

4. Cut down on energy usage: Use energy-efficient light bulbs and appliances, and turn off electronics when not in use. This can help you save money on your monthly energy bills.

5. Shop smart: Look for deals and discounts when shopping for groceries and other household items. Consider buying in bulk or buying store brand items instead of name brand.

By implementing these cost-saving strategies, you can reduce your monthly expenses and free up more money to put towards your mortgage payments.

Explore government programs and resources

In addition to cutting down on expenses and increasing your income, there are a number of government programs and resources available that can help you keep your mortgage payments under control. One option to consider is the Home Affordable Modification Program (HAMP), which was created to help homeowners who are struggling to make their mortgage payments. This program offers loan modifications and other forms of assistance to help you reduce your monthly payments and avoid foreclosure.

Another program to look into is the Hardest Hit Fund, which provides funding to state housing finance agencies to help struggling homeowners avoid foreclosure. Depending on where you live, you may be eligible for assistance with your mortgage payments, including principal reductions, loan modifications, and even assistance with your property taxes.

Finally, it’s worth noting that some states offer their own programs to help homeowners who are struggling to make their mortgage payments. Check with your state housing agency to see what options are available to you.

If You Are Self Employed

Being self-employed comes with its own set of challenges, especially when it comes to managing mortgage payments. While you may have a more flexible schedule, your income may not always be consistent, making it hard to budget and manage your expenses. Here are a few tips to keep your mortgage payments under control:

1. Keep track of your income and expenses - It is essential to have an accurate understanding of your finances. Record all your earnings and expenses, including any business-related costs.

2. Separate your personal and business expenses - Make sure you have separate accounts for personal and business expenses. It will make it easier to keep track of your finances, and it can help you avoid confusion at tax time.

3. Keep your taxes up to date - Stay on top of your taxes to avoid any financial surprises down the line. It is crucial to understand the tax deductions available to self-employed individuals, such as home office deductions.

4. Consider income averaging - Income averaging allows you to smooth out your income over a period, which can be helpful if your earnings are inconsistent. It can make it easier to budget and manage your expenses.

5. Make additional payments - If you have extra funds, consider making additional mortgage payments. This can help you pay off your mortgage faster and save on interest charges.

Being self-employed may require some additional effort when it comes to managing your mortgage payments, but with careful planning and budgeting, it is entirely possible to stay on top of your finances. By keeping accurate records, exploring your tax options, and making additional payments, you can successfully tackle an increase in your mortgage payments. We recommend using cost saving payroll company for online payslips for your employees.

If You Are On Benefits And Low Income

If you are on benefits or have a low income, the prospect of an increase in your mortgage payments can be daunting. However, there are still steps you can take to manage your finances and keep your payments under control.

Firstly, it’s important to remember that there are government programs and resources available to support those on low incomes. You may be eligible for benefits or grants that can help you cover your mortgage payments or reduce your overall expenses.

Another option is to look for ways to increase your income, such as taking on part-time work or exploring other sources of income like renting out a spare room or selling unwanted items. Even small increases in income can make a big difference when it comes to managing your mortgage payments.

In addition, it’s crucial to evaluate your expenses and look for ways to cut back where possible. This could mean shopping around for better deals on utilities, or cutting back on discretionary spending such as dining out or entertainment.

If you are struggling to keep up with your mortgage payments, it may also be worth considering refinancing or renegotiating your mortgage. This could involve changing the terms of your mortgage to make it more manageable, or even seeking the assistance of a mortgage broker to help you find a more affordable deal.

Ultimately, it’s essential to take a proactive approach when it comes to managing your finances and keeping your mortgage payments under control. With careful budgeting and strategic planning, it’s possible to navigate the challenges of an increase in mortgage payments even when on a reduced salary or low income.

If You Are A Single Parent

As a single parent, managing your mortgage payments can be a daunting task, especially if you are the sole breadwinner for your family. Here are some tips to help you keep your mortgage payments under control:

1. Seek Financial Assistance:

As a single parent, you may be eligible for government programs that provide financial assistance. Look for programs that can help with housing costs or that provide extra funds for single parents.

2. Consider Downgrading Your Home:

Downsizing may be a tough decision, but if your mortgage payments are getting out of hand, it may be a necessary one. If you have more space than you need, you could consider selling your home and purchasing a smaller one that is more affordable.

3. Consider Co-Owning Your Home:

Sharing your home with someone else can help you reduce the burden of mortgage payments. You could co-own your home with a family member or a trusted friend who could help with the mortgage payments.

4. Rent Out a Room:

Renting out a room in your home is another way to earn extra income to pay your mortgage. You could rent out a spare room to a tenant, or you could list your space on vacation rental platforms like Airbnb.

5. Create a Budget:

Creating a budget is important for any homeowner, but especially for single parents. List your income, expenses, and prioritize your payments. Stick to your budget as best as you can, and look for ways to save money on expenses like groceries and utilities.

Being a single parent comes with its own set of challenges, but keeping your mortgage payments under control should not be one of them. Use the tips above to help you manage your mortgage payments, and always remember that help is available.

Be A Winner

On the way to financial stability, there are challenges, but the most important thing to do is to maintain a positive outlook. The additional expense of a mortgage payment will be tough, but it's not impossible to make work. When you take time to reflect on your finances and revisit your budget, you can more clearly see what you need to be doing in order to avoid further financial difficulties.

Don't hesitate to look for refinancing or a mortgage renegotiation that will significantly reduce your monthly payments, or ways to increase your income and cut down your expenses for that matter.

Those struggling with limited funds or on low incomes should be aware of available government resources, as well as the guidance of professionals from non-profit organizations to reduce financial pressures.

Be a winner and enlist the support of friends, family, and professionals. By being positive and looking at the situation with the correct mindset, you can actually tackle the challenge of increased mortgage payments.