Payslip deductions: what they are and why you should care

Understanding payslip deductions is an essential part of financial literacy. Your salary slip is an important document that outlines your total earnings and the deductions taken from them. It's important to understand what deductions are taken from your salary and why so that you can better manage your finances. In this blog post, we will explain what payslip deductions are and why you should care about them.

Tax

Tax deductions are the most common type of deduction that appears on your payslip. It is money taken from your salary before you receive it and paid directly to the HMRC (HM Revenue and Customs). The amount of tax that you pay depends on the amount of money you earn, as well as any tax reliefs or allowances you may be entitled to.

There is zero tax on the first £12,570 of income and a 20% basic tax rate on income up to £50,270, and a 40% rate on income over this level up to £150,000. The income of anyone earning more than £150,000 per year will be subject to an additional 45% tax.

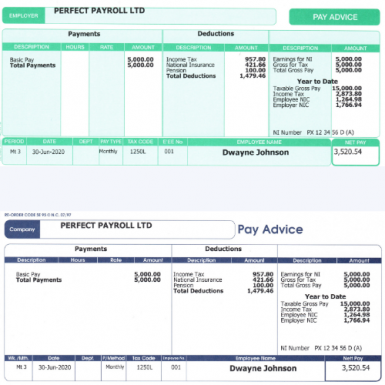

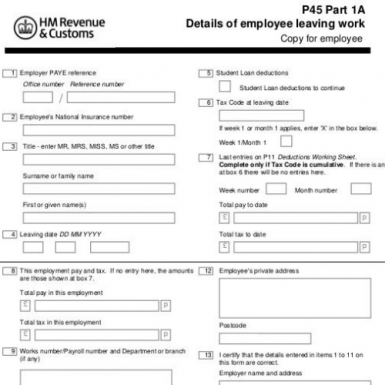

The tax will be deducted from your salary at source; this means that the tax will be deducted from your paycheck before it is sent to you. Pay As You Earn (PAYE) ensures you do not have to pay back too much at the end of the year. Your payslip should detail how much tax has been deducted each month so you can track your payments and make sure everything is correct. If you need to make any changes to your tax deductions, such as claiming a tax relief or allowance, you should contact HMRC for advice.

National Insurance

National Insurance is a type of tax you pay in the United Kingdom. It is deducted from your pay as part of your payslip deductions. The money collected is used to pay for state benefits like pensions and unemployment benefits.

National Insurance contributions are usually split into two parts: the Class 1 contribution and the Class 2 contribution.

Class 1 Contributions:

Class 1 National Insurance contributions are paid by employed people who earn more than £242. This is the level at which you start to pay National Insurance. The amount of National Insurance you pay depends on how much you earn and is usually between 12% and 14%.

Class 2 Contributions:

Class 2 National Insurance contributions are paid by self-employed people who make a profit of £6,725 or more per year. They must pay a flat rate of £3.05 a week.

It's important to know about your payslip deductions so that you can budget your money correctly and ensure you have enough to cover all the bills and expenses you need to pay. Understanding what deductions come out of your wages will also help you plan for your future and keep track of your finances.

Student Loans

Student loans are a common deduction on payslips and can be confusing for many employees. A student loan is a money borrowed from the government to help pay for higher education tuition fees and/or living costs. In the UK, student loans are usually repaid through Pay As You Earn (PAYE) deductions from wages, which means that any earnings above a certain threshold will trigger deductions from your paycheque.

The amount deducted from your payslip each month depends on your income, and any unused loan amount is repaid when you leave employment. In some cases, employers may deduct more than the standard rate of repayment if you are earning more than expected.

It's important to keep track of your student loan repayments and to make sure they are paid correctly. Your employer should also be aware of your student loan status and what deductions should be taken out of your wages. If you need any further information on student loan repayments, you should contact the Student Loans Company directly.

Pension

Employer-provided pension deductions might appear on your payslip, as may self-administered deductions.

If your employer offers a pension, he will pay into it too. The amount he contributes is proportional to the salary you earn, so for every dollar you earn, you'll save about sixty cents toward retirement. This will be represented by an equal contribution to retirement savings on the part of both the employer and the employee.

Rather than being just a portion of your paycheck automatically deducted, your pension funds are in fact being saved up as an investment in your future. With your pension plan, when you're retired, you will be able to spend your golden years in peace without having to worry about your finances.

If you don't understand the pension deductions on your payslip, the best way to contact your employer and find out about their pension scheme is by directly asking them to explain the details.

Other Deductions

There are a variety of other deductions that may appear on your payslip. These deductions can include payments such as child support, court orders, garnishments, and union dues.

Child Support: Child support payments are mandatory and are deducted from the employee’s wages if they have an order in place. This money goes to the custodial parent in order to help support the children.

Court Orders: Court orders can be issued for a variety of reasons and require the employee to pay a certain amount each month. This could include repayment for a loan or for past due taxes.

Garnishments: A garnishment is a legal document that allows a creditor to take money from your paycheck in order to satisfy a debt. Creditors must get a court order before taking this action, so it is important to stay on top of any debts you owe in order to avoid this.

Union Dues: Union dues are usually deducted from employee’s wages and go towards funding the union and its activities. This amount is typically calculated as a percentage of the employee’s wages.

It is important to understand all of the deductions that appear on your payslip so that you know exactly where your money is going. Make sure to review your payslip carefully each month in order to ensure that all deductions are accurate.