What is a Payslip?

A payslip is a document issued by an employer to their employees at the end of each pay period. It contains information about the employee's pay, including their wages, deductions, and taxes. Payslips are used to confirm that an employee has been paid correctly and accurately. For employers, having a payslip system in place helps to ensure that payroll processes run smoothly and efficiently. Let’s take a closer look at what payslips are and why they are important for both employers and employees.

What is Included on a Payslip?

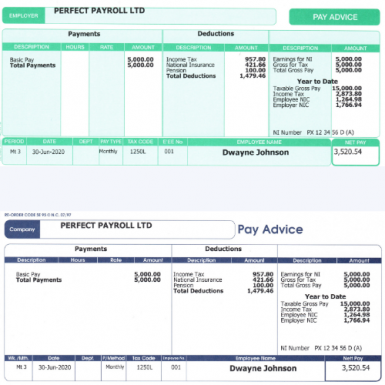

A payslip typically includes the following information: the employee’s name, employer name and address, payment period (e.g., week or month), gross wages (the total amount earned before any deductions), deductions (e.g., taxes, benefits, etc.), net pay (the total amount after all deductions have been taken out), hours worked (if applicable), rate of pay (if applicable). The payslip should also include any other relevant information such as overtime payments or bonuses earned during the payment period.

Why Are Payslips Important?

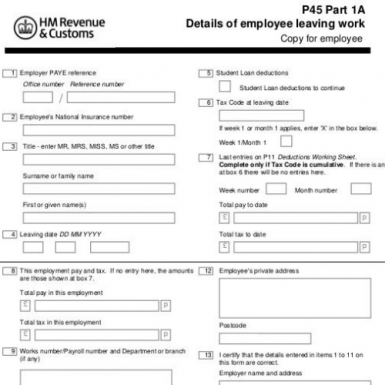

Payslips provide employees with an accurate record of their wages for each pay period so that they can track their earnings over time. This can be particularly useful if an employee needs evidence of income for loan applications or other purposes. In addition, it serves as proof of payment in case there is ever any dispute between employer and employee regarding wages owed or unpaid hours worked. Furthermore, it helps employers ensure that they are fulfilling their legal obligations when it comes to payroll processing and tax compliance.

What Are the Benefits of Using Electronic Payslips?

More businesses are choosing to switch from paper-based payslips to electronic ones due to the numerous benefits they offer both employers and employees alike. Electronic payslips are more secure than paper-based ones as they can only be accessed via secure logins with unique usernames and passwords which makes them less susceptible to fraud and identity theft. They also save time for both employers and employees since there is no need for printing out documents or manually entering data into spreadsheets—all wage information can be stored securely online in one central location which can then be easily accessed from anywhere in the world from any device with internet access! Additionally, electronic payslips help reduce costs associated with printing, storing, managing, distributing physical documents as well as errors caused by manual data entry mistakes which could lead to costly fines from tax authorities if not addressed promptly.

Conclusion

In summary, having a well-designed payslip system in place ensures that both employers and employees meet all legal requirements regarding payroll processing and tax compliance while also providing them with accurate records of their earnings over time. By switching from paper-based payslips to electronic ones businesses can benefit from improved security measures as well as cost savings associated with printing/storing/distributing physical documents plus fewer errors due to manual data entry mistakes which could otherwise result in hefty fines from tax authorities! Ultimately it’s up to each business owner or manager to decide whether traditional paper-based payslips or modern electronic ones would best suit their individual needs but either way having some form of systematic documentation in place is essential!