What is epayslip and its benefits

epayslip are electronic digital payslips which are either emailed or downloaded from employer’s payroll portal. These payslips are equally relevant to employment payroll structure with the following features: they are instantly downloadable, they do not have a potential to get lost, they generally have a no downloadable restriction, and there is no obligation to keep the paper copy. For simplicity, e payslip products are referred to as ‘Digital Payslip’s’ and one of the purposes is to reduce carbon footprint, but some payroll companies are aware that the paper version payslips are widely used in the relevant industries.

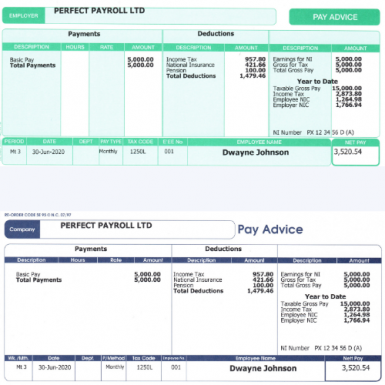

The format of epayslips is no different from normal payroll document. It displays series of information about tax deduction, National Insurance number, hours worked, Year to tax, monthly salary, annual salary, employer address and employee details etc. The payroll companies are seeking customer views on good practice. Industries (including banks, building societies, other lenders, trade bodies, brokers, credit rating agencies, consultants) are still asking for payslips as proof of earnings.

While the www.getpayslips.com is focusing on the types of epayslips, there may be some implications for other type of payroll business model, in keeping with the intention of replacing it with paper version payslip. This blog does not propose a new payroll framework. However, we invite our customers to provide responses to this article as part of any recommendations it may need relating to epayslip affecting payroll matters.

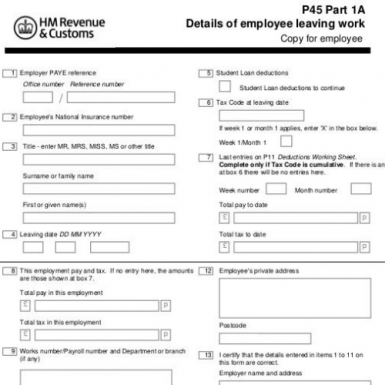

In the UK, there is often a need of payslips in securing finance, loans, or mortgages. For an applicant to meet minimum finance requirement the payslips are required. This means either directly or indirectly – by a range of different financial institutions, including life insurers, banks, building societies and other lenders. employee payslip has become a standard requirement of the UK finance market.

It is common for lenders to require payslips as part of the loan applications. There is a risk that employee payslips help lenders calculating and reducing lending risks as borrowers’ payslips showcase the financial income of the borrower. This may lead to the acceptance and rejections of mortgages. Conversely, if the payslips are used in addition to bank statements will improve the chances of mortgage acceptance, then application performance may be superior.

From the payroll companies’ point of view, the future value of the epayslip in financial world at any given date depends on whether the financial institution accepts digital form of payslips. If the financial does not bite, the digital payslips will take over the paper version payslips in full; if it does bite, the digital payslip will be restricted to the value of zero. Thus, the present value of the epayslip is equal to paper version payslip. The computation of these epayslips is done the same way it has been done for paper version payslips.

Conclusion

In assessing epayslip benefits, we consider that it may be helpful to introduce a concept of the ‘Effective Value’ of epayslip. The Effective Value would be used to further offer the digital payroll services and could change significantly over time.