What to Do When You Lose Your P45 Form

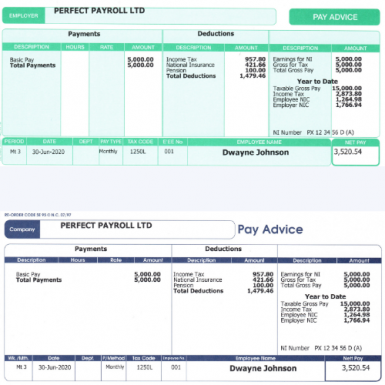

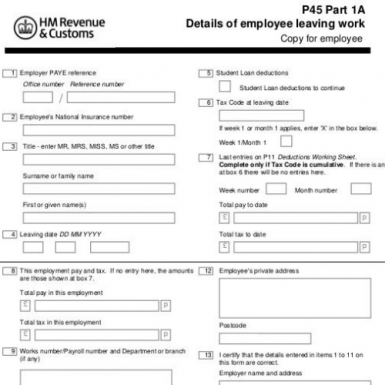

As a business owner, you know that the P45 form is one of the most important documents you have. The P45 form details your employee’s salary and tax information when they leave your business, so it's vital to keep it safe. But what happens if you lose it? Here's what business owners need to know about replacing a lost or damaged P45 form.

Reporting Lost or Damaged Forms

The first step is to report any lost or damaged forms directly to HMRC. This can be done via phone or online, and you should explain exactly why the form was not produced on time. In some cases, HMRC may ask for documentation providing more evidence of the loss or damage; this could include an insurance claim letter if necessary. Once HMRC has received and accepted your explanation, they will issue a Replacement Certificate Number (RCN). This RCN will allow you to reissue the form with minimal fuss.

Reissuing a New Form

Once you have obtained an RCN from HMRC, you can reissue a new P45 form using that number instead of the original one. Ensure that all fields are filled out correctly and accurately; this includes the employee’s name and address as well as their bank account details and previous employer information. Make sure that each box is completed in full—even if all boxes are left blank on an original document, they should still be filled out for a replacement document. Once complete, send off the new P45 form to HMRC so that their records can be updated accordingly.

The Need for Replacement P45

In the UK, employers are required to provide every employee with a P45 form to prove their employment status and salary information. This document is especially important for employees who are leaving a job; it must be submitted along with other documents in order to receive any benefits or tax credits. It may also be used in the event of an audit or investigation carried out by HMRC (Her Majesty’s Revenue and Customs). Consequently, it is essential for both employers and employees to have access to accurate and up-to-date records of all P45 forms issued.

Final Steps

Finally, make sure you keep a copy of both the original and replacement forms in case either one needs to be referenced again in the future. It’s also important for businesses to ensure that these forms are stored securely as part of their payroll records; this ensures not only compliance but also data protection best practices too!

Conclusion

Replacing a lost or damaged P45 form isn't something any business wants to do—but occasionally it's necessary! Taking these steps helps ensure that everything is handled correctly and quickly so your team can get back up and running without any delays or hiccups along the way. By following simple steps, businesses can easily help their employees replace lost or damaged forms quickly and efficiently – ensuring that everyone stays up-to-date with accurate records at all times! With this helpful advice from Metric Marketing, replacing a lost p45 just got easier, With due diligence and careful record keeping, replacing lost or damaged forms doesn't have to take long at all!